If you’re looking for the best frugal living tips, then you’ve come to the right place. This post is all about my best tips for living frugally and how to save money fast.

Society has made it extremely difficult to live frugally, especially when we’re constantly scrolling through social media, where we are always being sold to. Think about it: as you scroll through your feed, what do you see? Advertisements from brands and influencers.

It’s literally the influencers’ job to persuade you to buy something! They get paid for promoting the brand, and when you click their link and make a purchase, they earn a commission.

Through social media, we’re constantly bombarded with new pieces of clothing, shoes, jewelry, grocery items, and the list goes on. Our society has become even more dependent on trends. But let me tell you something you might not want to hear: trends come and go.

You don’t need to chase after every trend on social media. You don’t need to try that new perfume, laundry detergent, or leggings—you get the point. You don’t need everything you see.

If you find yourself wanting to keep up with every trend, maybe it’s time to take a break from social media or start unfollowing people. Trust me, your life isn’t going to fall apart because you’re not on social media! In fact, you’ll probably feel a lot better.

In this post, I will go over all the ways I save money and am able to live frugally.

If you enjoy this post, then check out these:

- Easy Ideas for Bedroom Refresh on A Budget

- Staging a Bedroom Tips to Maximize Value and Space Experts Swear By

My Top Frugal Living Tips for 2024:

- Only Purchase What You NEED, Not What You WANT.

- There’s Always a Sale—So Wait for It.

- Stop Ordering Out. This includes fast food, restaurants, and buying coffee.

- Stop Following Every Trend.

- Practice Living More Simply.

Without further ado, let’s dive into this post!

This post is about frugal living tips.

1. Stop ordering food out.

First, you don’t need to order food out. This habit can really add up, and if you calculated your spending, I bet it would be a significant amount! Plus, ordering food is often much less healthy than making your own meals at home.

2. Only purchase if it’s on sale.

Second, only purchase items when they’re on sale is a huge rule for me! Almost everything goes on sale at some point, so stock up when it is. This way, you’ll never have to worry about buying when the prices are high.

3. Use apps on your phone for discounts.

If you know me, you know I have every app for all the places I shop—Starbucks, Dunkin’, Dairy Queen, Chick-fil-A. Check where you shop; chances are they have an app! If you don’t have your grocery store apps, you’re definitely losing money. (The stores I shop at, Shaw’s and Stop & Shop, both have apps where I can clip digital coupons to ensure I don’t miss any potential savings.)

4. Take advantage of credit card savings.

I don’t know about you, but I love credit cards! I have multiple, each with different reward offerings. For instance, my Target Red Card saves me 5% on every purchase, my Chase travel card earns points for traveling, and my Discover cashback card gives me cash back. You get the gist—credit cards come with perks!

As long as you never buy anything you can’t afford and always pay your credit card bill, they aren’t scary. Plus, credit cards can help build your credit. If you use them responsibly, they can be a great tool. Pro tip: set up auto payments so you’ll never miss a due date!

5. Stop going to the nail salon.

This is for all my girlies out there: stop going to the nail salon! I’ve never been someone who justifies spending $50+ on my nails. Whenever I want my nails done, I do them myself. One year for Christmas, I asked for a nail dip kit, and it works great!

After some practice, I’ve gotten the hang of it, and now my nails look professional—just like I spent a bunch of money at the salon. If you’re interested in getting an at-home nail dip kit, here’s the one I have and really like.

6. Buy a few nail polishes at the Dollar Store.

I often find brand-name quality nail polishes at the dollar store, which are great to have on hand at home. All you need are a few of your favorite colors. At-home pedicures are easy to do and will save you so much money in the long run.

Think about it this way: if your pedicure costs you $50 every month, that adds up to $600 a year! You can easily treat yourself at home for a fraction of the cost.

7. Thrift Shopping.

Next, I love thrift shopping and the thrill of the hunt so this frugal living tips is easy for me. You can thrift almost everything, but the main thing I focus on is clothing. Pro tip: if you have a Salvation Army nearby, shop on Wednesdays when all the colored tags are half off!

8. Stock up on sales.

I touched on this a bit when I mentioned only buying items on sale. If you have something you know you’re going to use and it’s a tried-and-true product for you, why not stock up? This way, you won’t have to buy it at full price because you’ll already have it on hand.

9. Use your gift cards on things you need.

You might think I’m a bit weird, but I love using my gift cards on practical items that I actually need. For example, if I receive a Target gift card, I’ll use it for things like deodorant, toothpaste, face wash, underwear, and bras—you get the point. I dislike spending money on personal care products, so using a gift card really helps!

10. Ask for stuff you actually need as gifts.

If someone asks what you want for your birthday or Christmas, consider asking for things you actually need, like cleaning supplies, personal care items, or clothing. If you don’t feel comfortable asking for specific items, you can always request a gift card to a place like Target, where you can buy what you need.

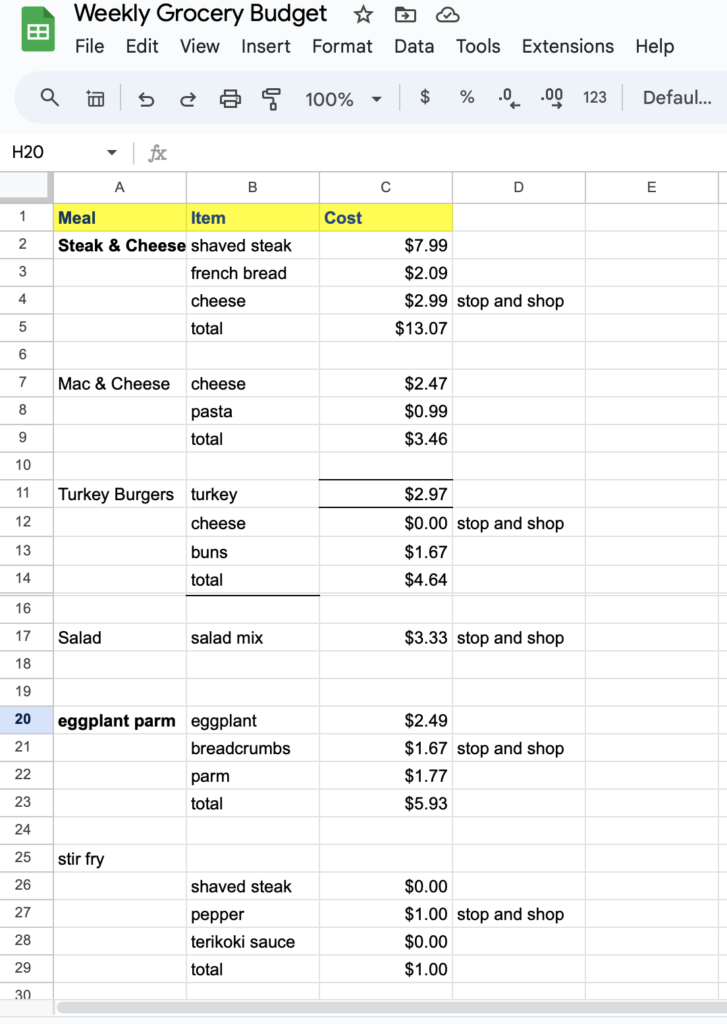

11. Plan out & budget your grocery list in advance.

There’s nothing worse than walking into a grocery store and having no idea what to get! I’m telling you right now, planning your grocery list in advance will save you frustration, time, and money. What I do is study the weekly flyers and digital coupons, then plan all my meals around those.

12. White strips at home.

If you admire white teeth like I do, you’ll appreciate this frugal living tip. Teeth whitening at the dentist can cost hundreds or even thousands of dollars, and I don’t know about you, but I’m not willing to pay that. Instead, I’ll buy Crest White Strips when they’re on sale or use a gift card!

I’ve always used Crest White Strips, and I personally think they’re the best! They don’t make my teeth sensitive, and I actually notice a difference.

13. Go to your local library.

The library is an underrated gem. It’s free and full of books you can borrow and return when you’re done. Not only does visiting the library save you money, but it also helps minimize potential clutter at home.

14. Shop at the Lululemon outlet store or we made to much section online.

If you love Lululemon like I do, you should check out the “We Made Too Much” section on their website—it’s essentially their sale section. If you have a Lululemon outlet nearby, it’s definitely worth a visit! I’ve used my gift cards at the outlet to score a pair of leggings for just $19 and a swim top for only $9.

15. Use one streaming service at a time.

Let’s be real for a minute: you don’t need Netflix, Hulu, Disney+, and others all at once. Consider using one at a time to avoid paying subscription fees for multiple services every month. Frugal living is all about minimizing unneeded costs.

17. Stop following influencers.

If you find yourself constantly buying things from social media that you don’t actually need, it might be time to stop following those accounts. Remember, a social media influencer’s job is to share and entice you to buy what they’re promoting. They earn money through partnerships with brands and by linking products through affiliate links.

18. Sell things you don’t use anymore.

If you haven’t used something recently, it’s probably time to sell it. For clothes, I’ve had great luck using Poshmark; their app is user-friendly and a good way to sell clothes and shoes I no longer want. You can also use Facebook Marketplace to sell other home-related items like decor, furniture, rugs, and more.

19. Use your change.

I’m the kind of person who likes to pay with exact or close-to-exact cash. While the change may seem small, it can really add up. Plus, I don’t have to break any bills when I use my change!

20. Stop ordering drinks when you’re out.

To be honest, I’m not a big drinker, so this frugal living tip is easy for me. I hate spending money on alcoholic drinks when I’m out at a restaurant. I once listened to a business podcast featuring a restaurateur who mentioned that restaurants often make a significant portion of their profits from drinks, sometimes even more than from food!

21. Make enough for leftovers.

When we plan our dinners, we always aim for leftovers for lunch the next day. If you can get four meals out of one cooking session, I consider that a major win! This approach lowers costs and makes life easier since you won’t have to worry about lunch the next day.

22. Stop buying brand name makeup products.

Okay, you might hate me for this one! If there’s an expensive product I’ve used before or want to try, I always Google to see if there are any dupes. For instance, I bought a Tarte skin tint with one of my Ulta gift cards, and while I love it and it works great, it’s $42. So, I’ve searched for possible dupes and found one that I think will give me similar results for a fraction of the price.

23. Do it yourself aka DIY

In today’s world you can easily Google how to do literally anything. DIY projects are a fantastic way to stay busy while saving money. Whether it’s upcycling furniture, creating home decor, or tackling simple repairs, there’s immense satisfaction in making something yourself. Plus, these projects can add a personal touch to your space and provide a sense of accomplishment that store-bought items often lack.

23. Budget and track your savings

Another way to practice frugal living and saving money is to create a budget and track your spending. By knowing where your money goes each month, you can identify areas where you can cut back. Setting specific savings goals can also motivate you to stick to your budget and prioritize essential expenses over non-essentials.

25. Focus on living more simply.

You don’t need the newest products if you already have something that works for you. Focus on living more simply. Before you buy anything, ask yourself, “Is this a need or a want?”

Ultimately, living frugally can actually be fun and enjoyable. Just think about all the money you’ll save! My best advice is to put all the money you save into a savings or retirement account.